Investing with Cherry Hill

At Cherry Hill, we always start with you, the investor. We take the time to understand everything that you need, and want, from your investments so that we can invest for you.

What it is like to invest through Cherry Hill.

We invest with meaning and purpose.

When it comes to investing, you need to know that your retirement is going to match your vision, that your children are going to be able to afford education, and that you’re going to feel secure in your future.

Our purpose is to make all of those things come true for you.

We invest for you.

We start with you, the investor, to understand everything that you need and want from your investments. Then we develop an investment strategy that works for you, not everyone else.

With access to the whole investment world, we’re able to offer an comprehensive variety of investment options, including custom-made securities available only in-house.

We invest using the best products available.

Like you, we were disillusioned with the investment products that were available. Too many were were structured to benefit the institutions, not investors, not you. We changed that by partnering with Harbourfront Wealth Management so now we can access the vast majority of the reasonable investments in the Canadian market place. From mutual funds to ETFs, stocks to bonds, GICs to private investments.

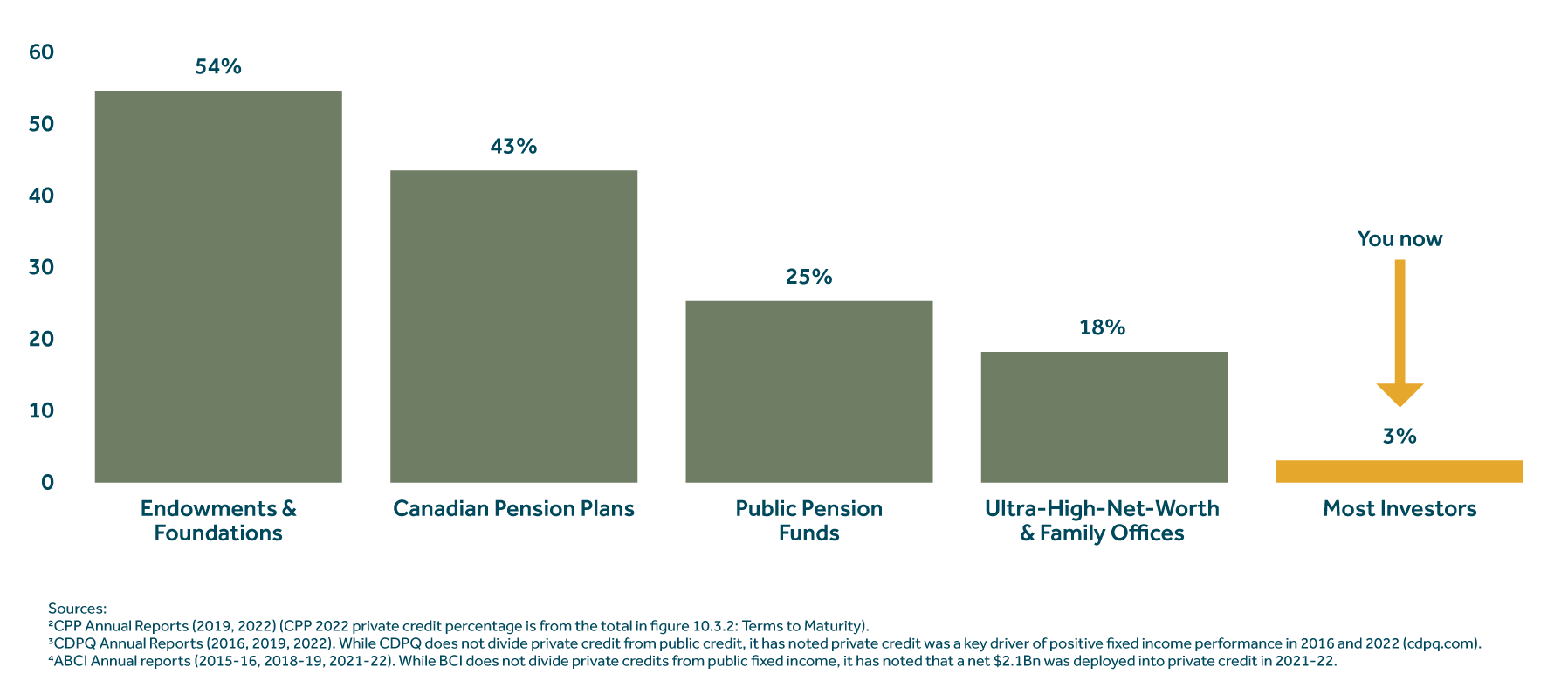

Invest like a pension.

The best managed pools of capital are pensions and endowments.

In Canada, thats the Canada Pension Plan (CPP), Ontario Teacher’s Pension Plan (OTPP), Healthcare of Ontario Pension Plan (HOOPP), Ontario Municipal Employees Retirement System (OMERS), etc.

In the US, its the Yale, Harvard, and Princeton endowment funds.

Through our partnership with Harbourfront Wealth, we are able to bring this Pension-Style Asset Management to the retail Canadian investor. All investing includes risk, and the risks here are unique and different than typical product like mutual funds, and that's the point! We’re able to offer an unusual amount of diversification, and “Diversification is the only free lunch” in investing - Nobel Prize laureate Harry Markowitz.

The Why

When you, as a retail investor, include pension style asset management and private market securities in your portfolio, you benefit from diversification, reduced volatility, and better expected risk-adjusted returns.

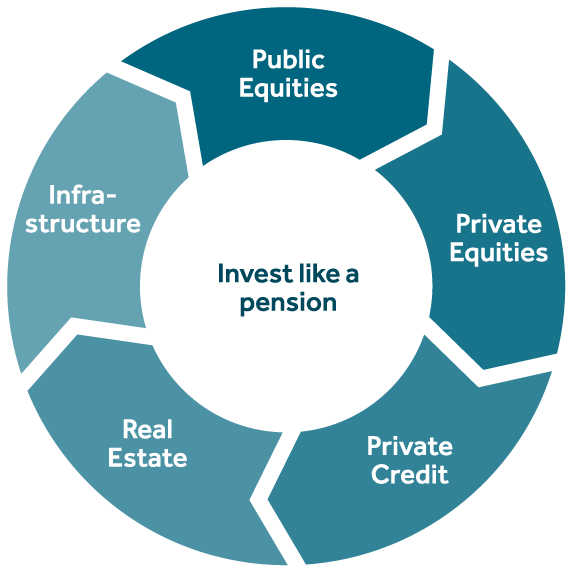

Infrastructure

Stable long-term returns, inflation protection, and diversification.

Real Estate

Consistent income, inflation hedge, and diversification

Private Credit

Attractive yields, lower volatility, and diversification.

Private Equities

High growth potential, access to unique opportunities, and diversification

Public Equities

Growth potential, liquidity, and accessibility.

Book a consultation with us.

Let’s schedule a call to meet each other and see how we can help you achieve a financial roadmap that helps you focus on what, and whom, means the most to you.